Climate Change Response and Management

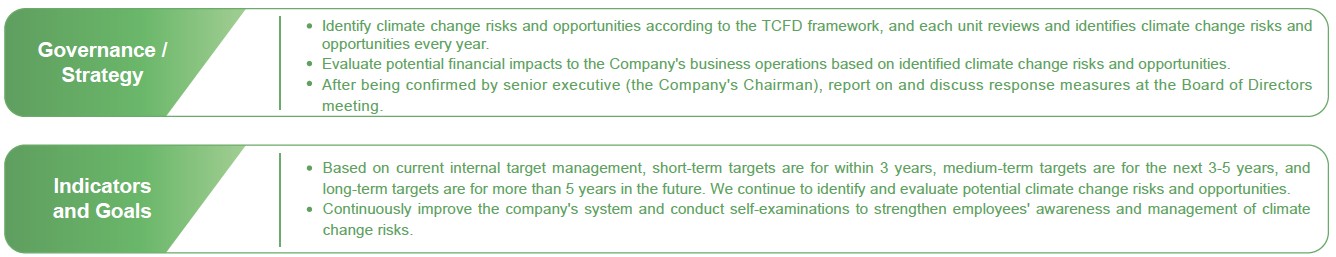

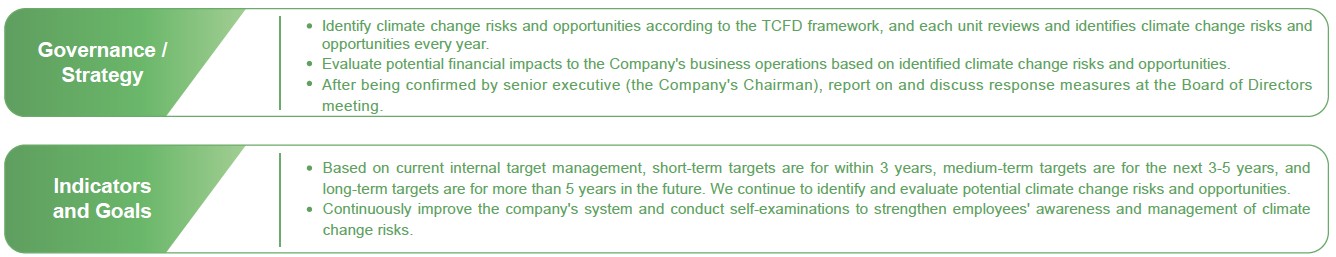

Overview of Climate-Related Financial Information Disclosure

In light of potential financial risks to business operations due to climate change, disclosing information related to climate change has become relevant in sustainability information disclosure. Brogent has set the target to reduce GHG emissions by 0.25% each year, and identified climate-related risks and opportunities in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) issued by the Financial Stability Board (FSB) and the Taiwan Stock Exchange Corporation Rules Governing the Preparation and Filing of Sustainability Reports by TWSE Listed Companies. Identification results are incorporated into the Company's overall risk management framework and serve as one of Brogent's sustainable development strategies.

Identification Process for Climate-Related Risks and Opportunities

Brogent continues to pay attention to climate-related policies and action plans of various industries in Taiwan and overseas, and reviews and evaluates various risks and opportunities that may be caused by climate change for matrix analysis, including: direct or indirect physical effects of changes in rainfall and climate patterns; changes in market demand caused by new policies and regulations; risks and opportunities brought by social aspects to the Company's business activities. These efforts aim to reduce climate change risks, seize business opportunities, and implement the Company's sustainability philosophy.

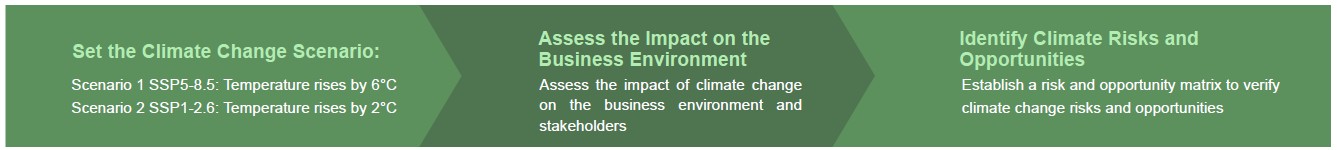

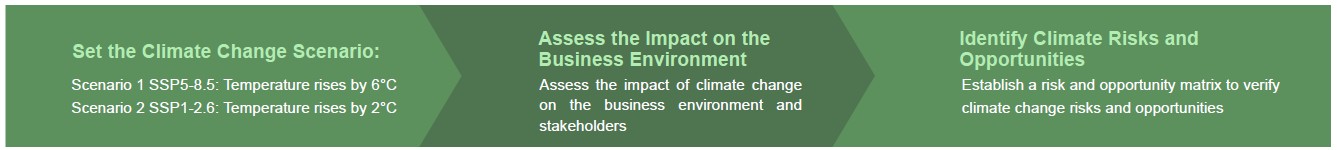

Brogent discusses climate change, summarizes information, and assesses risks and opportunities during meetings that look into climate change risks and opportunities. The specific process for identifying climate change-related risks and opportunities is as follows:

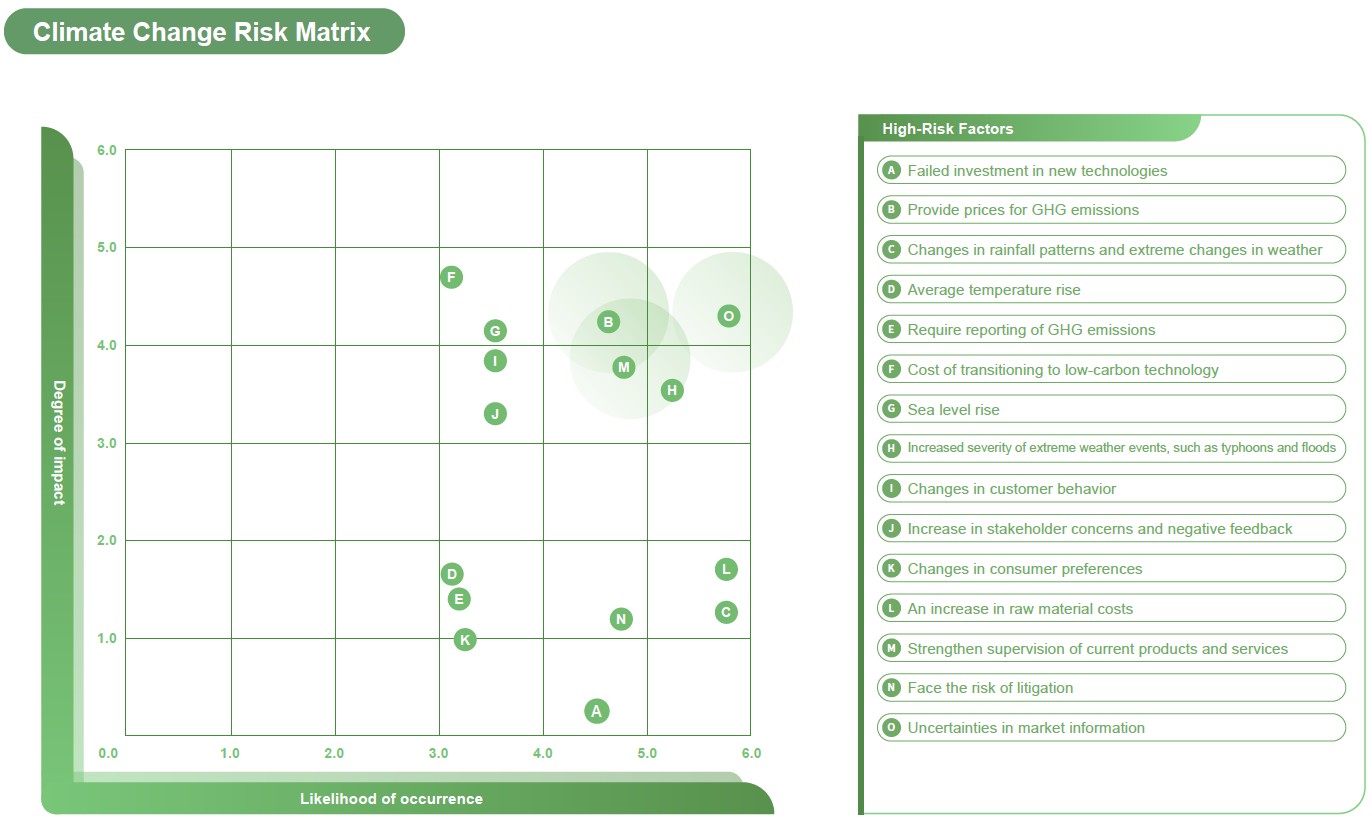

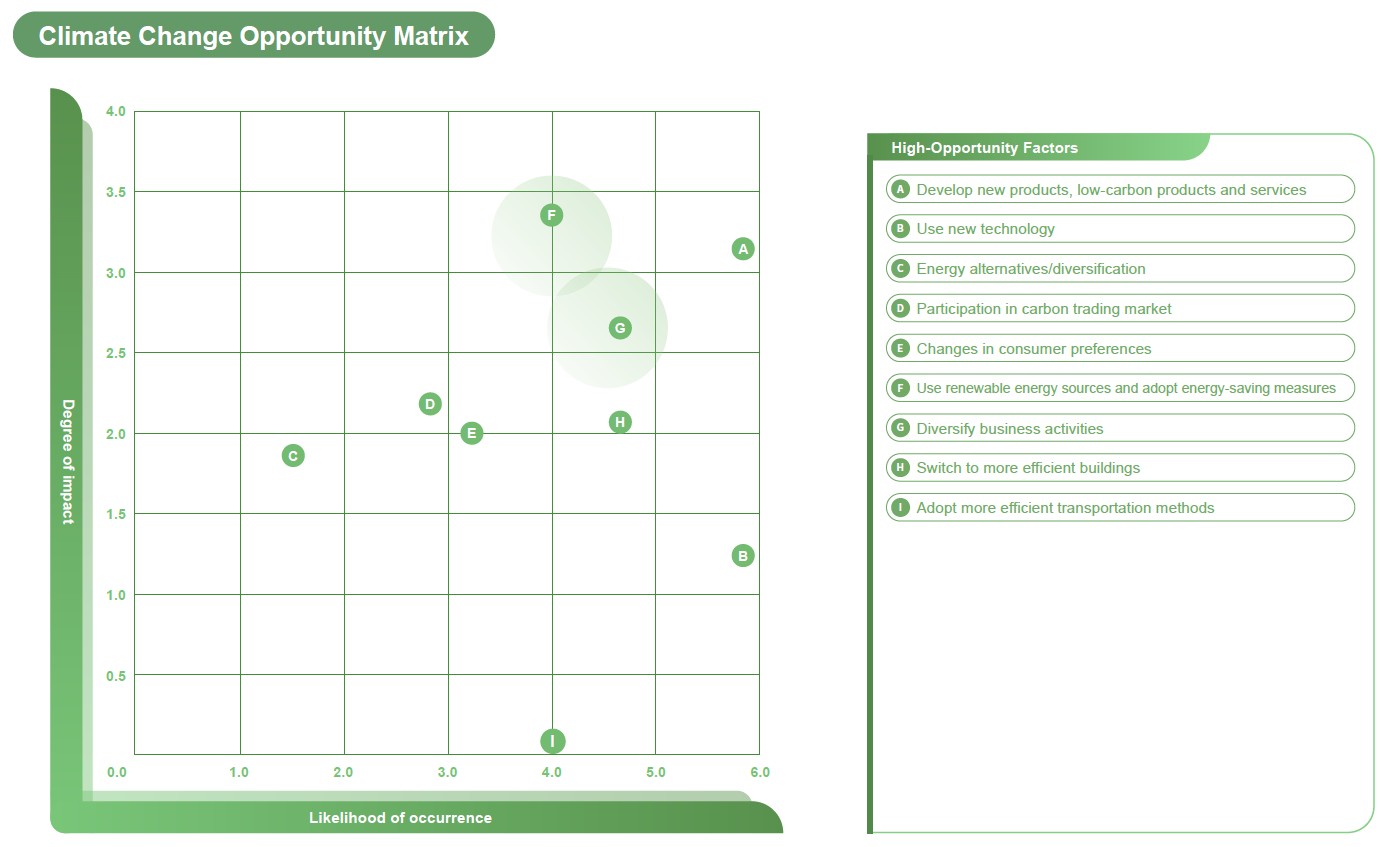

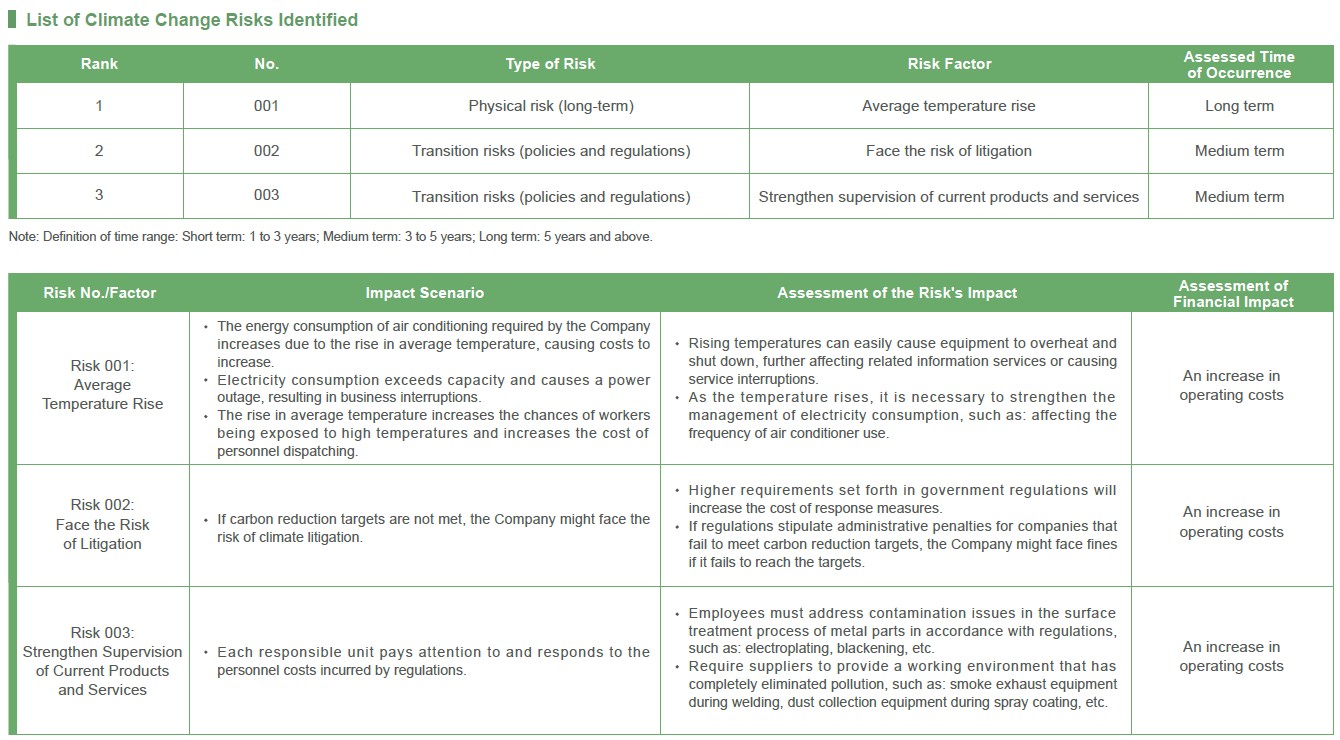

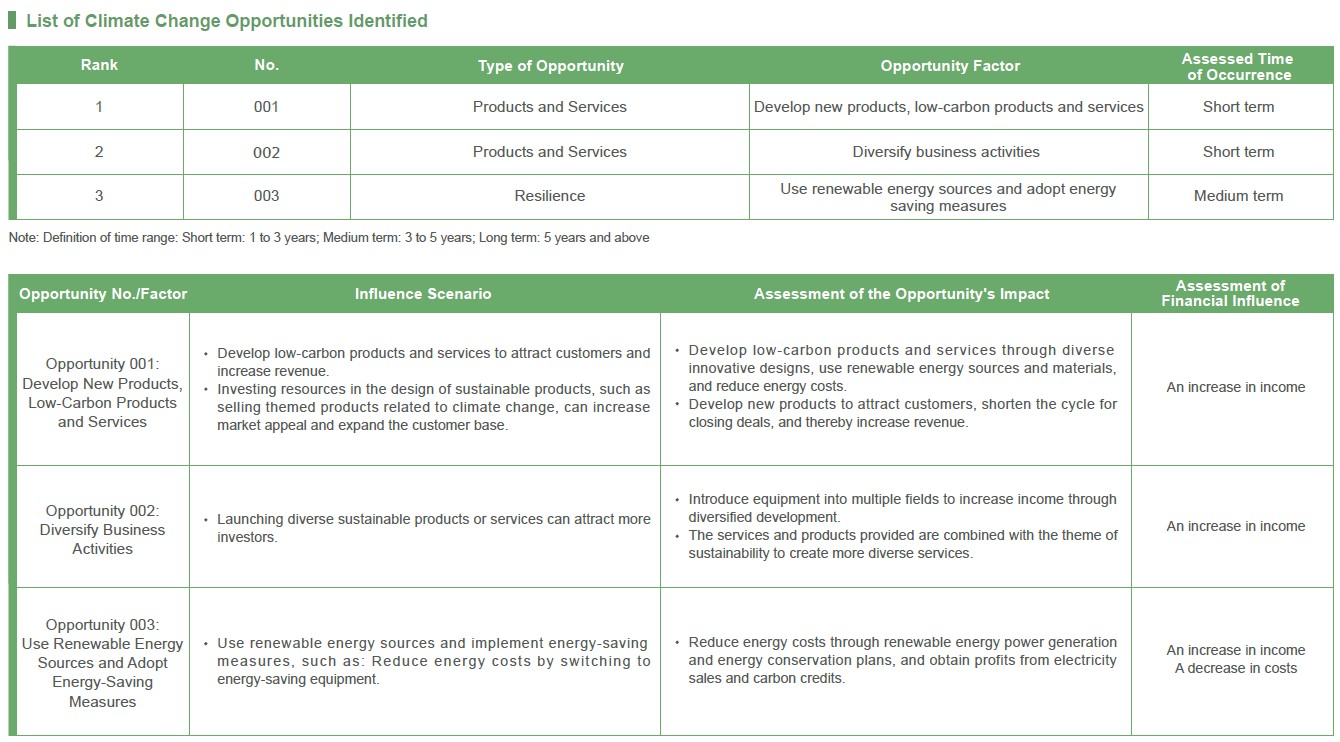

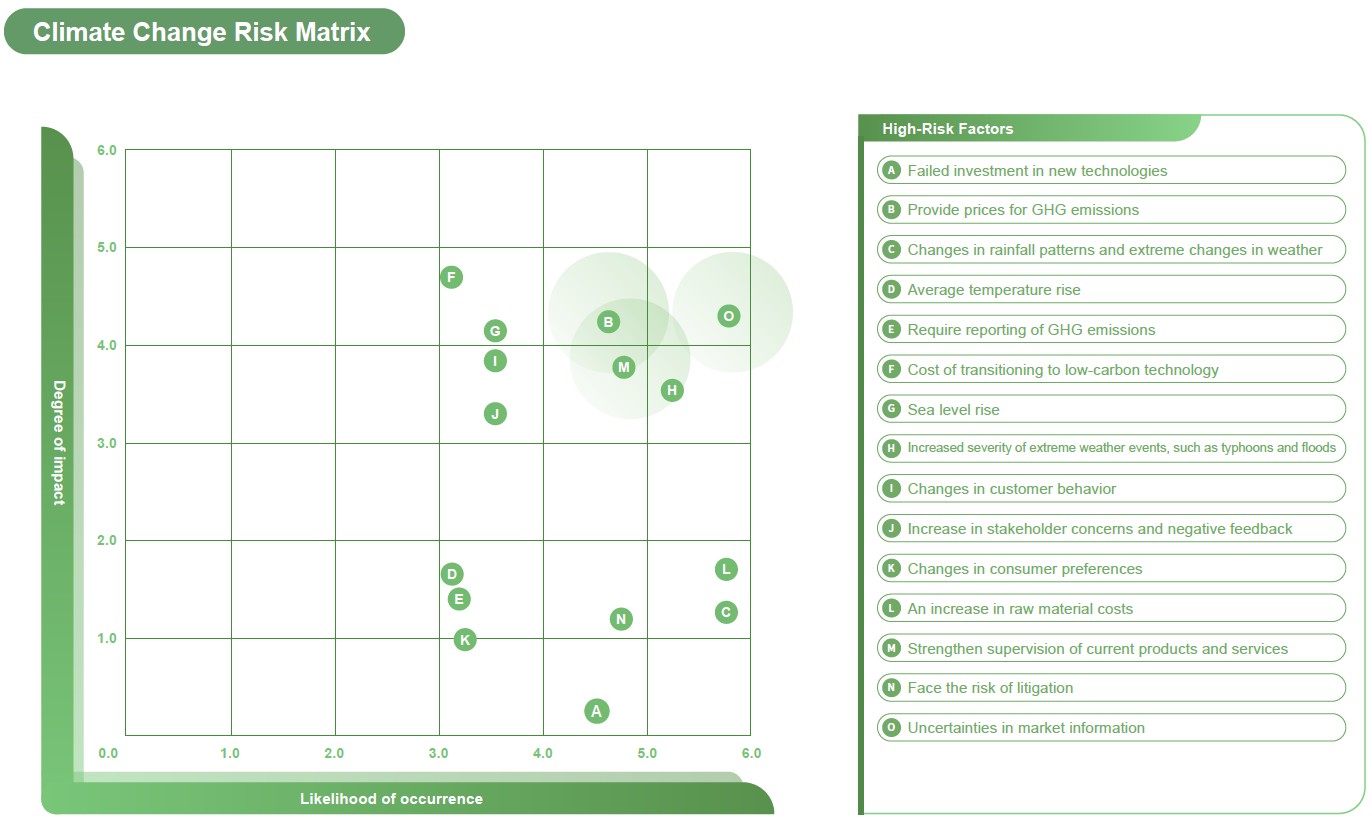

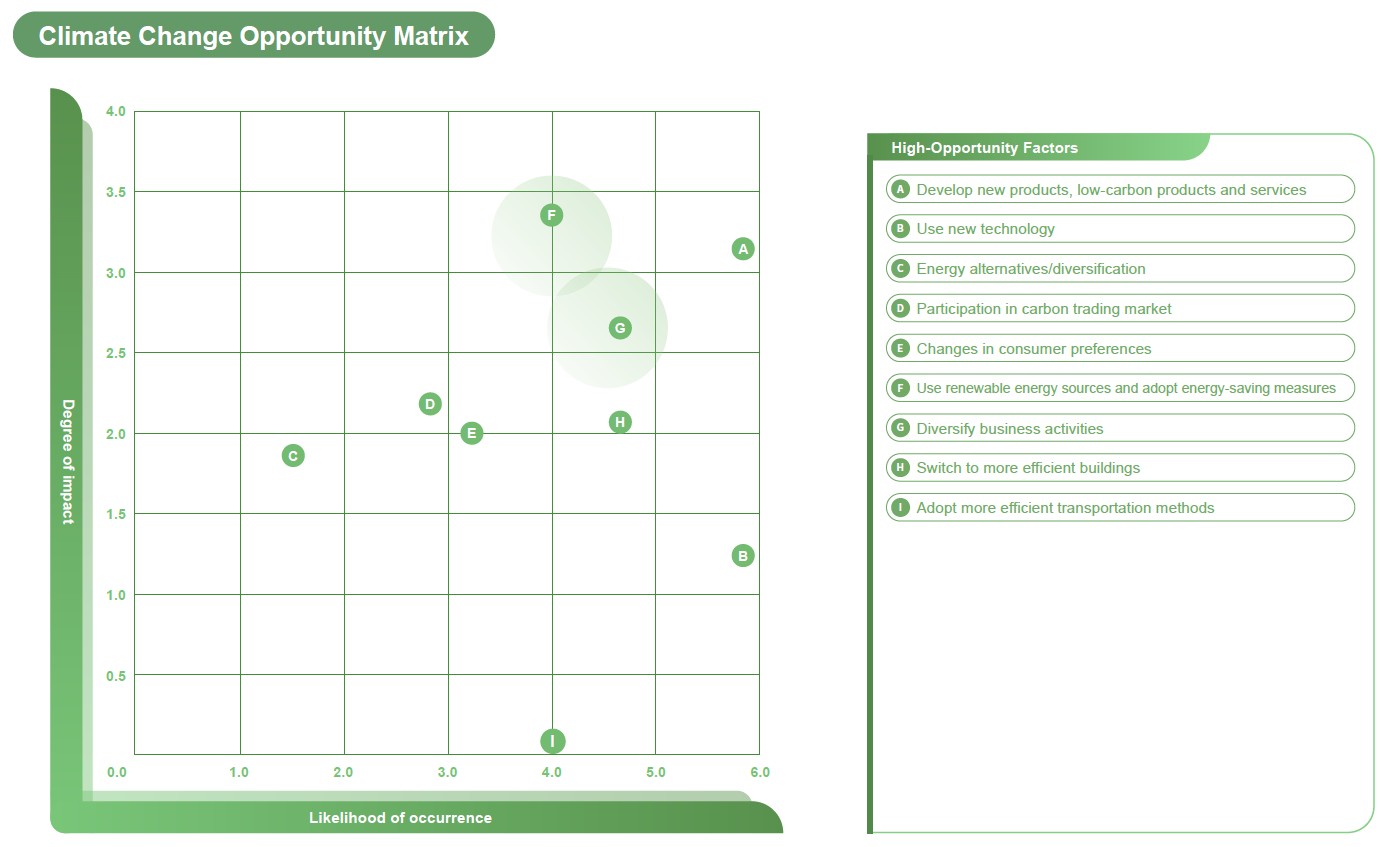

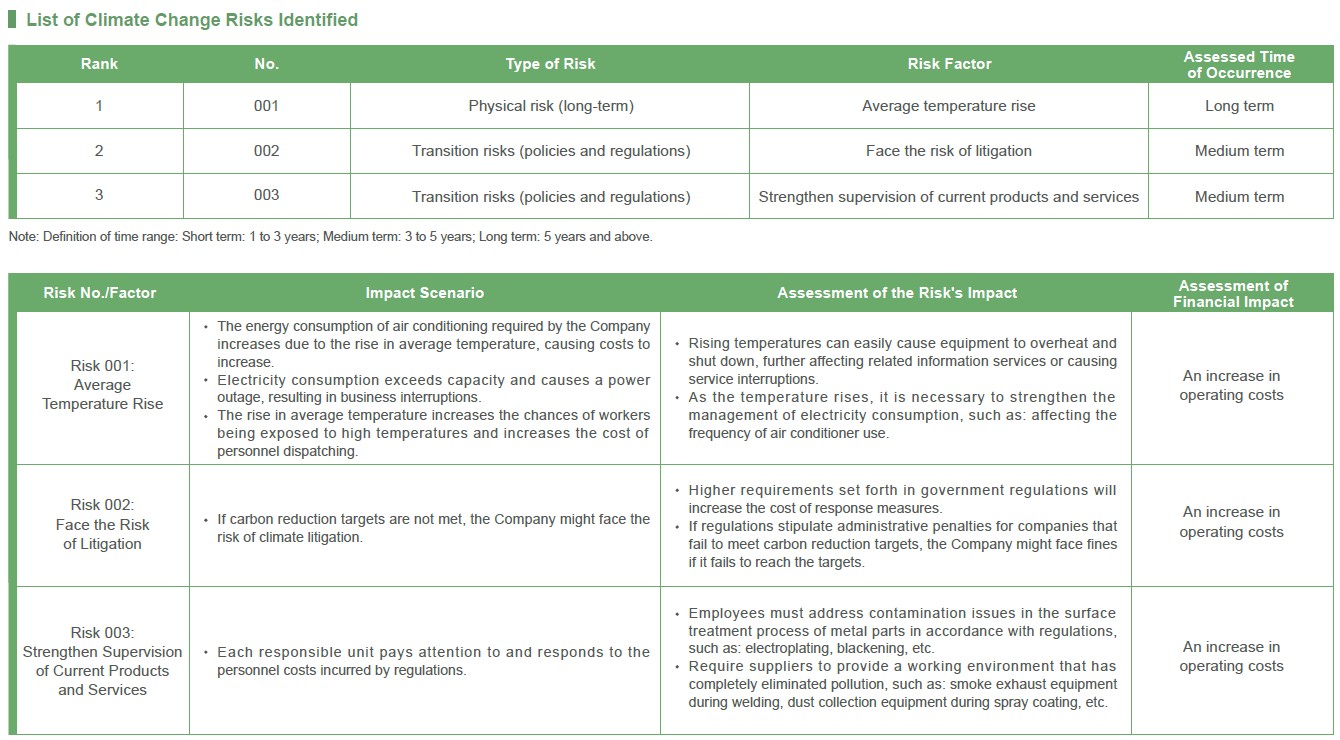

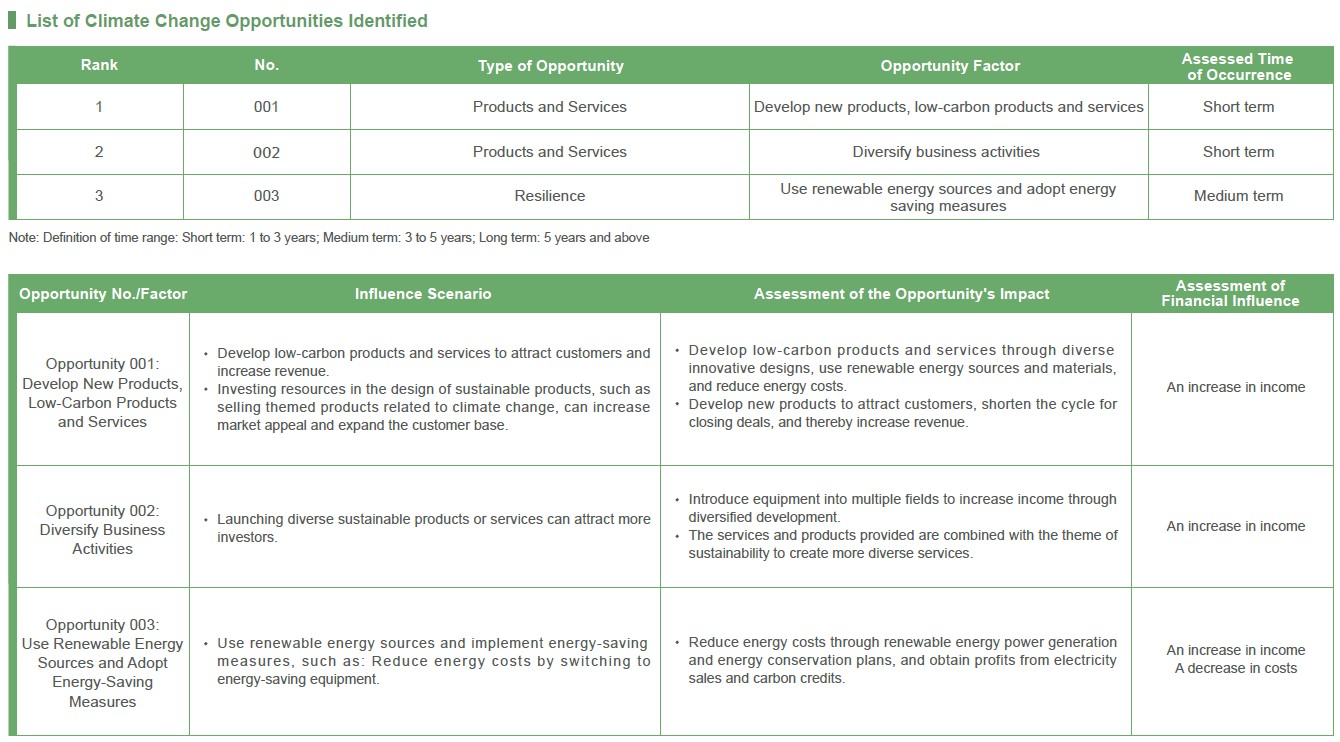

After completing the identification of climate risks and opportunities, we identified three high-risk factors and three high-opportunity factors of Brogent in 2023 based on the "probability of occurrence" and "degree of impact" of the risks or opportunities. Brogent's climate change risk matrix and opportunity matrix in 2023 are as follows:

Description of Climate Change-Related Risks

Description of Climate Change-Related Opportunities

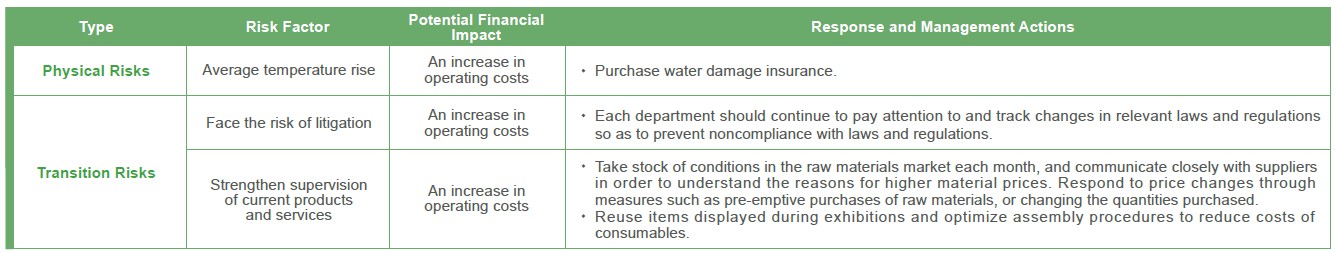

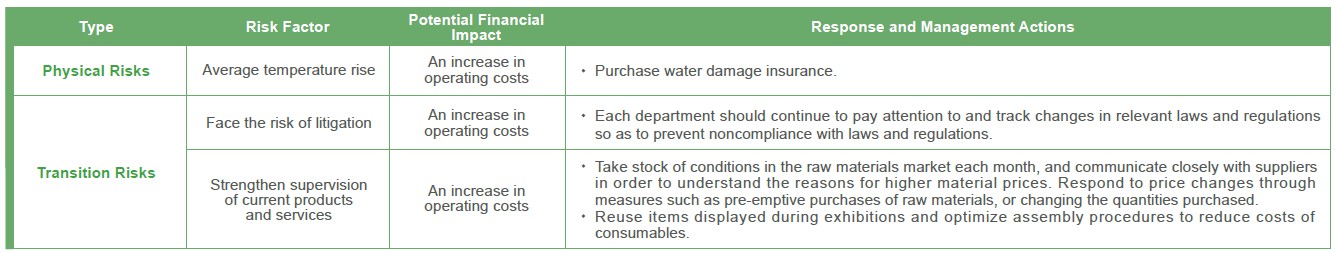

Response to and Management of Climate Change Risks

Integrate into regular risk management operations, establish specific improvement plans and risk indicators for each risk management item, preventing potential risks from posing a substantial or transitional impact to Brogent should they occur.

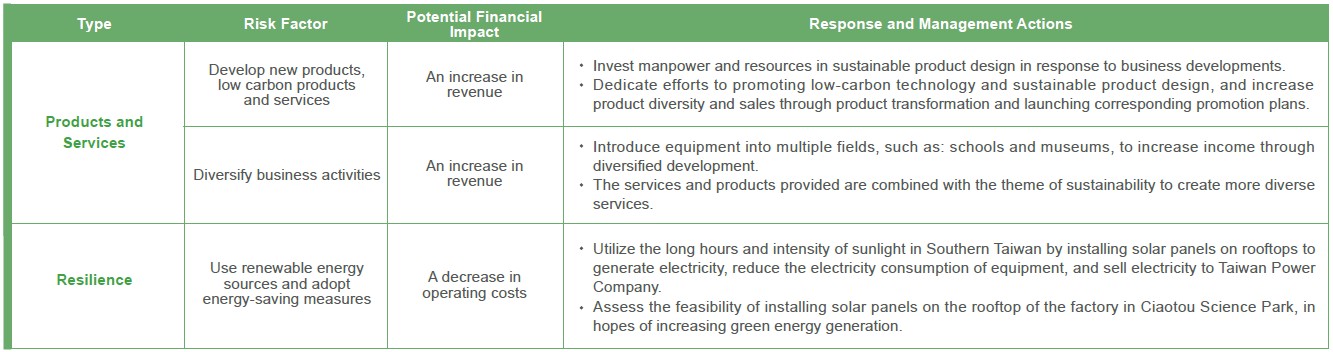

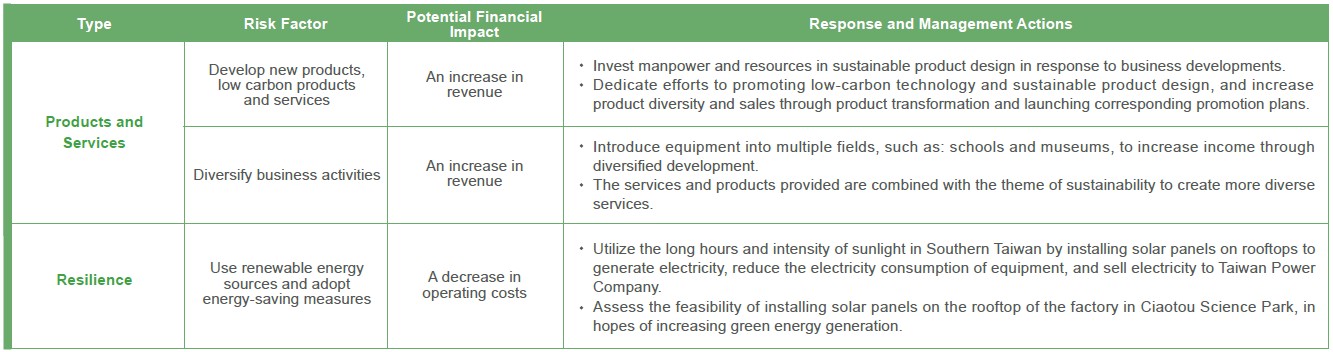

Response to and Management of Climate Change Opportunities

Identify opportunities that can allow Brogent to get ahead of the competition, helping us prepare the necessary investment or resource usage in advance to take advantage of these opportunities.

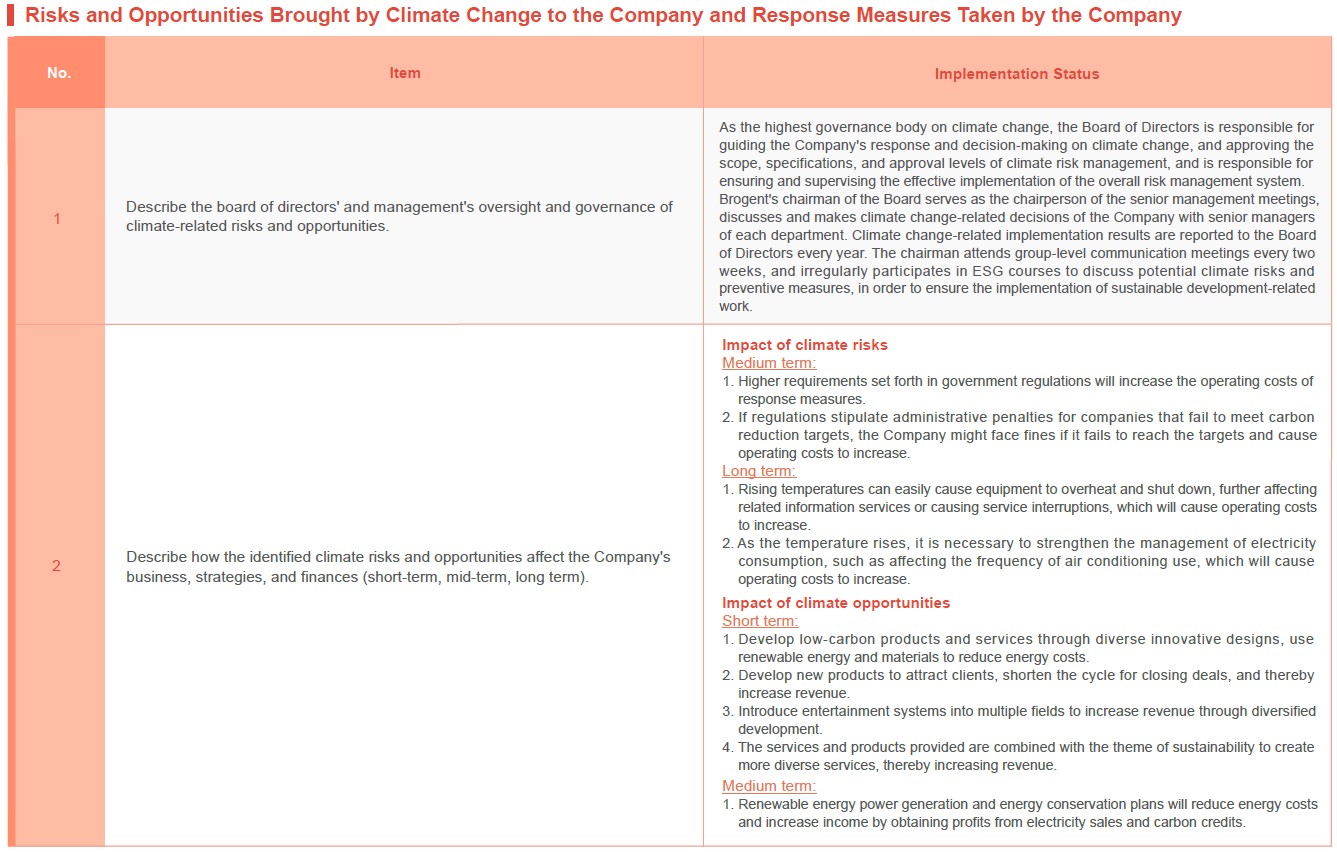

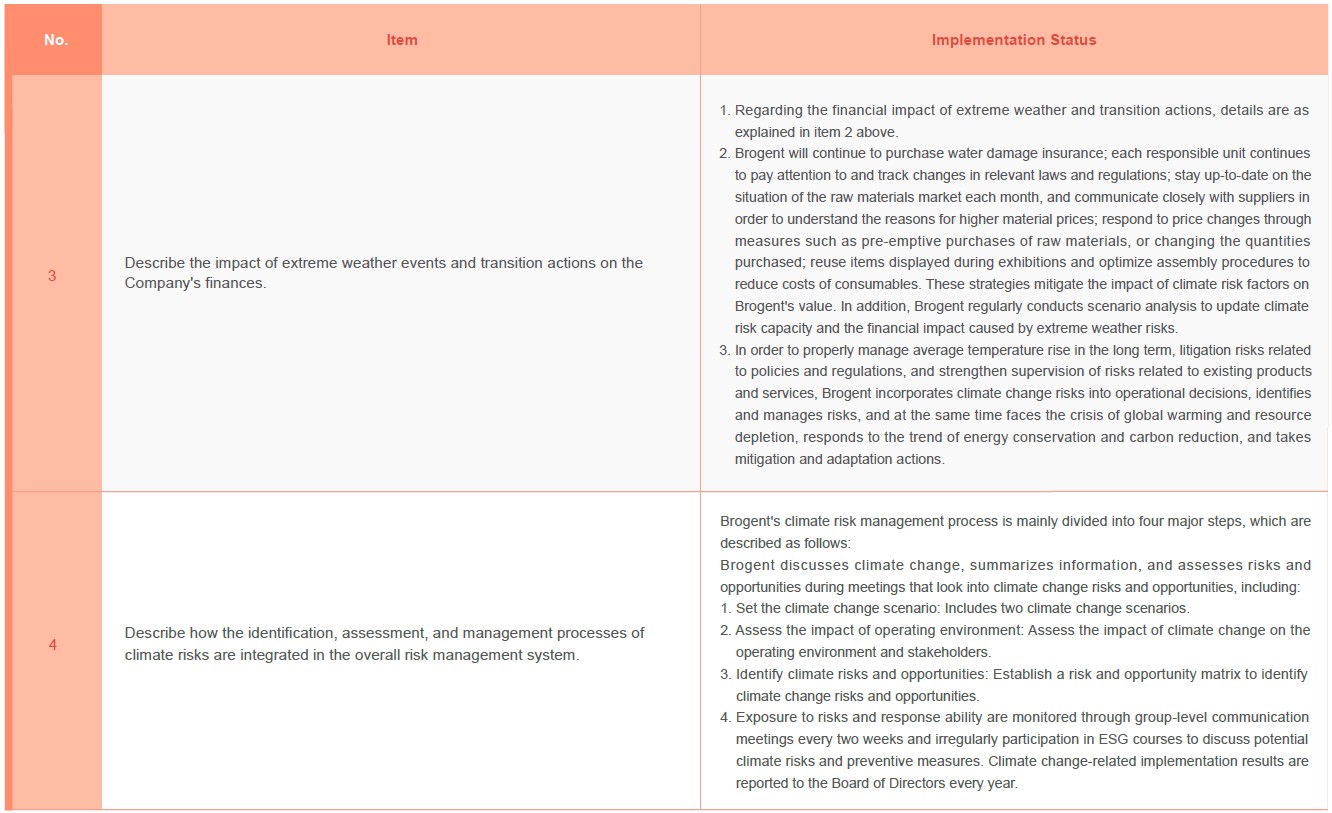

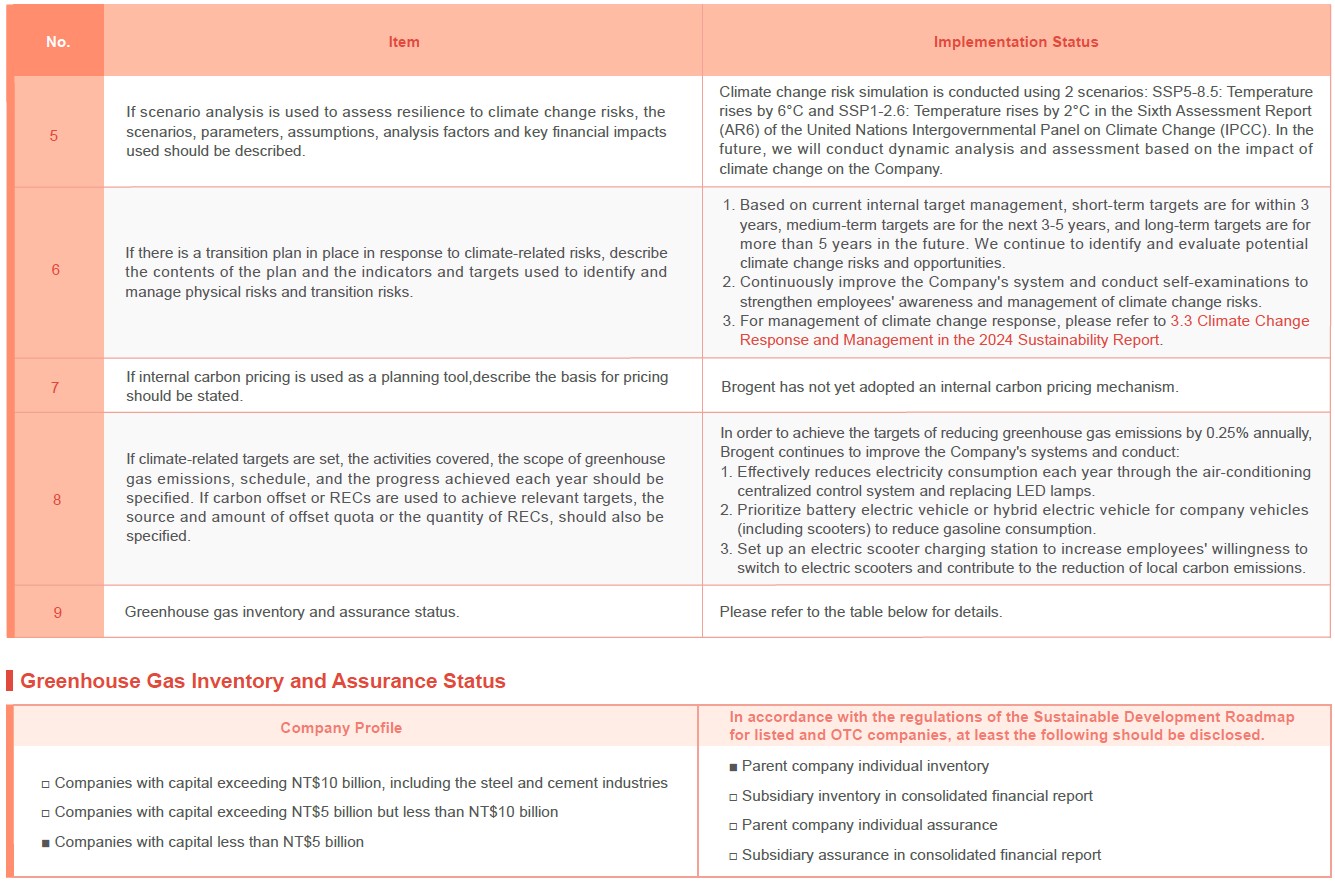

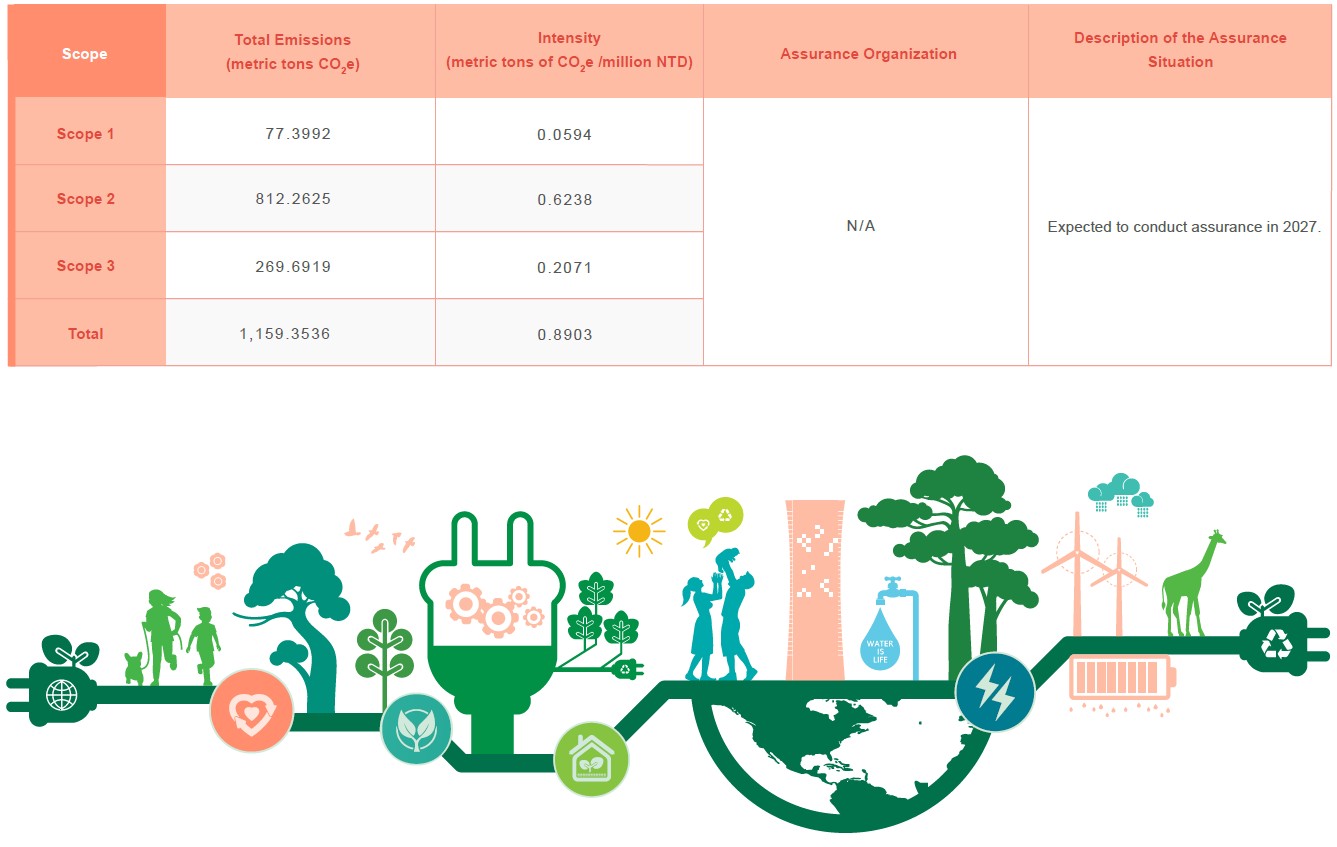

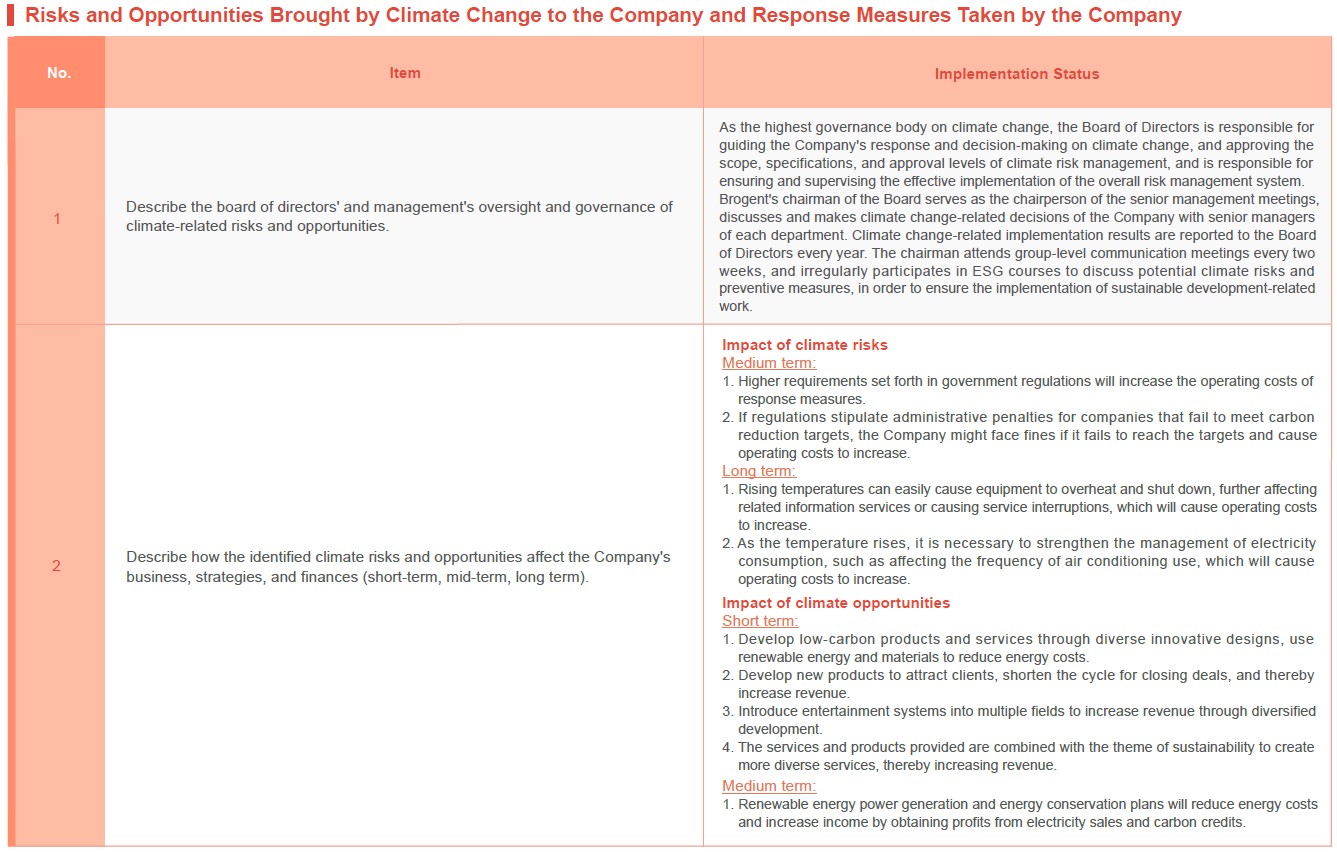

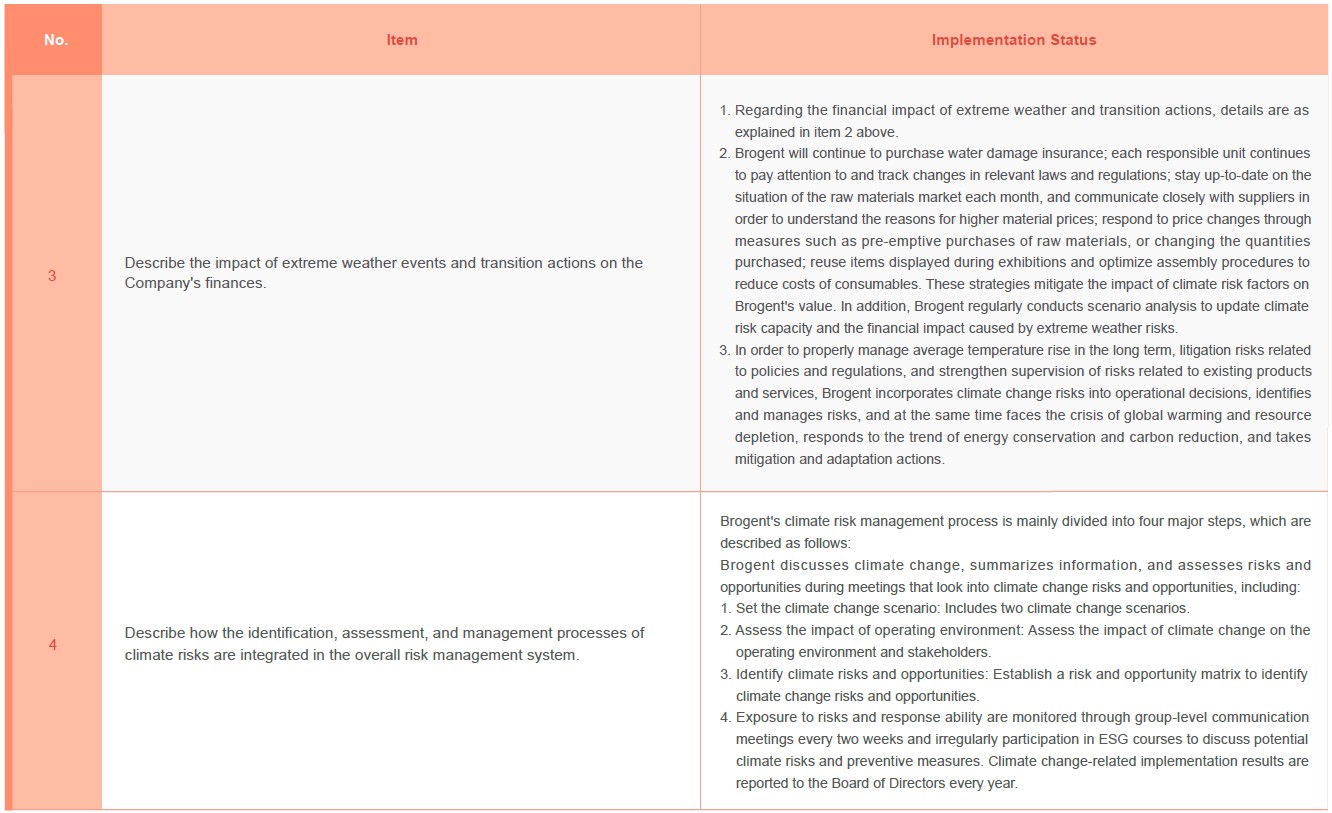

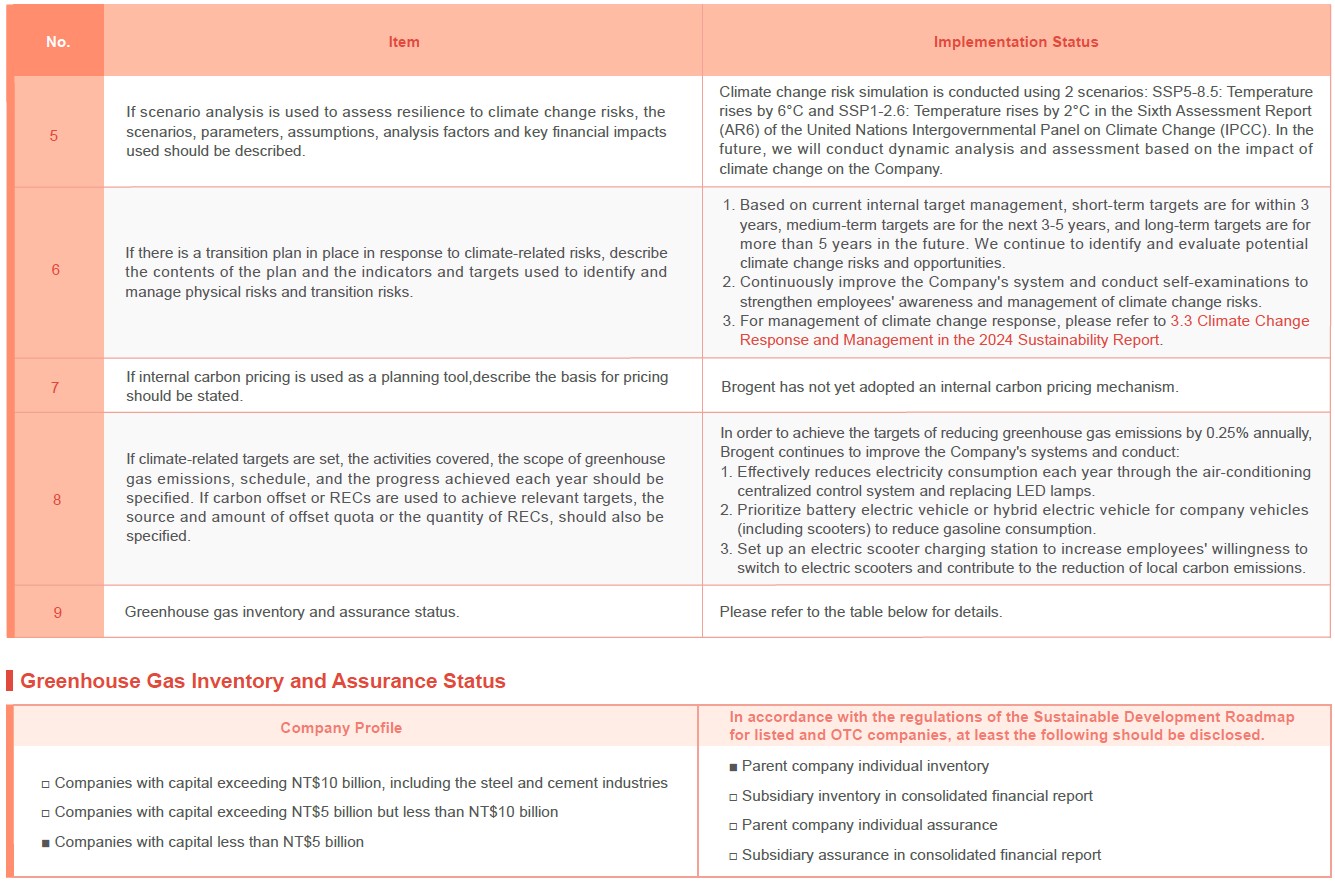

Comparison Table of Climate-related Disclosures

In light of potential financial risks to business operations due to climate change, disclosing information related to climate change has become relevant in sustainability information disclosure. Brogent has set the target to reduce GHG emissions by 0.25% each year, and identified climate-related risks and opportunities in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) issued by the Financial Stability Board (FSB) and the Taiwan Stock Exchange Corporation Rules Governing the Preparation and Filing of Sustainability Reports by TWSE Listed Companies. Identification results are incorporated into the Company's overall risk management framework and serve as one of Brogent's sustainable development strategies.

Identification Process for Climate-Related Risks and Opportunities

Brogent continues to pay attention to climate-related policies and action plans of various industries in Taiwan and overseas, and reviews and evaluates various risks and opportunities that may be caused by climate change for matrix analysis, including: direct or indirect physical effects of changes in rainfall and climate patterns; changes in market demand caused by new policies and regulations; risks and opportunities brought by social aspects to the Company's business activities. These efforts aim to reduce climate change risks, seize business opportunities, and implement the Company's sustainability philosophy.

Brogent discusses climate change, summarizes information, and assesses risks and opportunities during meetings that look into climate change risks and opportunities. The specific process for identifying climate change-related risks and opportunities is as follows:

After completing the identification of climate risks and opportunities, we identified three high-risk factors and three high-opportunity factors of Brogent in 2023 based on the "probability of occurrence" and "degree of impact" of the risks or opportunities. Brogent's climate change risk matrix and opportunity matrix in 2023 are as follows:

Description of Climate Change-Related Risks

Description of Climate Change-Related Opportunities

Response to and Management of Climate Change Risks

Integrate into regular risk management operations, establish specific improvement plans and risk indicators for each risk management item, preventing potential risks from posing a substantial or transitional impact to Brogent should they occur.

Response to and Management of Climate Change Opportunities

Identify opportunities that can allow Brogent to get ahead of the competition, helping us prepare the necessary investment or resource usage in advance to take advantage of these opportunities.

Comparison Table of Climate-related Disclosures